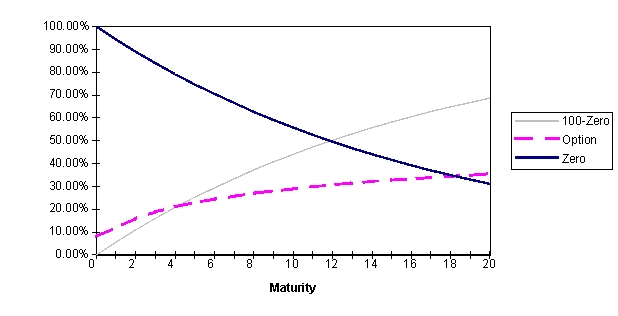

You're a banker. A client wishes to buy a guaranteed note with a 100% indexation to the stock index's growth. In other words, he doesn't want any coupon but requires 100% of the index growth. You wonder about the maturity of such a note. You check the prices of various index calls traded on the market for different maturities. Their strike is the current index level and their price is expressed as a percentage of this level. (For instance if the CAC is worth 3,000, the strike is 3,000 and the one-year maturity call trades at 11% of 3,000. You also check the price of a zero-coupon in percentage for various maturities. The following graph shows, for each maturity, the price of the option, that of the zero-coupon, and 100%-zero.  a. What is the maturity of the guaranteed note (coupon =0%, indexation =100%)? Justify.

a. What is the maturity of the guaranteed note (coupon =0%, indexation =100%)? Justify.

b. If as a banker, you want to make a profit, should you lengthen or shorten the maturity of that note? Explain why.

c. Everything remaining constant (that is, same volatility and interest rate), should the maturity of the guaranteed note be shorter or longer if the index pays a low dividend rather than a high one? Why?

Definitions:

Retail Stores

Physical or online locations that sell goods directly to consumers for personal or household use.

Composition

The arrangement or organization of elements in a work of art or literature, or the mixture of components in a product or substance.

Store Layout

The arrangement of physical elements in a retail space designed to optimize customer experience and sales.

Sensory Management

A strategy that involves managing and manipulating the sensory experience of consumers to influence their perception and behavior towards a product or environment.

Q9: Several years ago, when the Deutsche

Q19: A resident has AD. The person tends

Q29: Why did U.S. commercial banks have an

Q33: Drug addiction is a chronic, relapsing brain

Q49: A resident has osteoporosis. The person's care

Q54: The Immigration Reform and Control Act requires

Q72: Equal employment opportunity refers to actions required

Q77: Describe the role of a line manager.

Q97: Quadriplegia is paralysis<br>A) In the arms<br>B) In

Q98: Which of the following people would not