Strumpf Ltd. decides to issue a convertible bond with a maturity of two years. Each bond is issued with a nominal value of £100 and an annual coupon C; of course, C has to be determined. Each bond can be redeemed for £100 or converted into one share of Strumpf at the option of the bondholder.

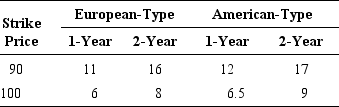

The current stock price of Strumpf is £90. The yield curve for an issuer like Strumpf is flat at 6%. Barings is ready to issue long-term options on Strumpf shares. The premiums on calls with one-year and two-year expirations are given below:

a. American-type calls are more expensive than European-type calls. Is it reasonable?

a. American-type calls are more expensive than European-type calls. Is it reasonable?

b. Assume that the bond can only be converted at maturity, after payment of the second coupon. What should be the fair coupon rate C, consistent with the above market conditions?

c. Assume that the bond is issued with the coupon rate determined above. The yield curve suddenly moves from 6% to 6.1% and the option premiums stay the same. What should be the new market price of the convertible bond?

d. Assume now that the bond can be converted on two dates (rather than one as above). These dates are the first year (right after the first coupon payment) and the second year as above. It is not possible to convert the two-year bond at any other date. Is it possible to construct an arbitrage portfolio allowing to price the fair coupon C with the above data? Be precise in your explanation and state what type of options you would need to price the bond.

Definitions:

Connectedness

Refers to the state or quality of being connected or interconnected, often used to discuss social bonds and relationships among individuals or communities.

Single Unit

A single unit in the context of physiological studies refers to an individual neuron or muscle fiber that can be identified or recorded from.

Figure-Ground Perception

The ability to distinguish objects (figures) from background (ground) in visual images, a fundamental aspect of visual organization.

Connectedness

The state or feeling of being connected and having close relationships with others.

Q1: Anxiety is<br>A) A vague, uneasy feeling in

Q1: Reincarnation is the belief that<br>A) The spirit

Q4: Exchange Rate Dynamics. Britain and Europe have

Q9: A tumor is<br>A) A lump in a

Q29: A manager who initiates change to take

Q29: Why is privacy important during rehabilitation?<br>A) It

Q46: Individuals with AIDS or HIV are "disabled"

Q63: Metastasis is<br>A) A benign tumor<br>B) Cancer<br>C) A

Q63: Jana has a two-week work schedule. During

Q81: Susan would like to achieve a better