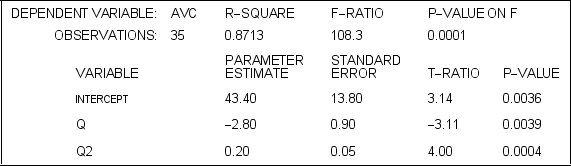

Straker Industries estimated its short-run costs using a U-shaped average variable cost function of the form and obtained the following results.Total fixed cost (TFC) at Straker Industries is $1,000.  If Straker Industries produces 12 units of output,what is estimated average total cost (ATC) ?

If Straker Industries produces 12 units of output,what is estimated average total cost (ATC) ?

Definitions:

Stock Split

A corporate action where a company divides its existing shares into multiple shares to increase liquidity without changing the shareholders' equity.

Par Value

The nominal or face value of a stock or bond as assigned by the issuing company, which may bear no relation to its market value.

Preferred Stock Dividend

Cash distributions that are paid to holders of a company's preferred shares at a specified rate and before dividends are paid to common stockholders.

Earnings Per Common Share

A financial metric used to gauge the profitability of a company on a per-share basis, calculated as net income less dividends on preferred stock divided by the average number of common shares outstanding.

Q4: A monopoly is producing a level of

Q5: With a cubic production function of

Q17: Counselling research has found that clients typically

Q24: A firm is considering the decision

Q32: A short-run production function was estimated

Q41: The less accurate consumer information is about

Q44: The following graph shows the demands and

Q50: A firm is considering the decision

Q55: Refer to the following figure.Two firms,A and

Q99: Given the table below,what is average