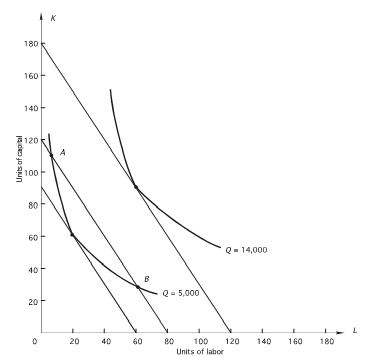

Refer to the following graph.The price of capital (r) is $20.  Why wouldn't the firm choose to produce 5,000 units of output with the combination at B?

Why wouldn't the firm choose to produce 5,000 units of output with the combination at B?

Definitions:

Current Ratio

A financial ratio that evaluates a firm's capacity to meet its short-term liabilities, which are due within a year.

Current Assets

Resources anticipated to be turned into cash, disposed of, or used up within a year or during the standard operational cycle of the company.

Current Liabilities

Short-term financial obligations that are due within one year or within a company's operating cycle.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term financial health and efficiency.

Q6: Use the following table to answer

Q13: Subjective probabilities are<br>A)determined from actual data on

Q15: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7882/.jpg" alt=" In the figure

Q19: A firm sells two goods (X

Q29: The following payoff matrix shows the

Q48: <span class="ql-formula" data-value="\begin{array}{c}\begin{array}{c}\text {Units of}\\\text {Labor}\\\hline1 \\2

Q58: Using time-series data,the demand function for

Q64: Suppose that the firm's only variable input

Q71: If the price elasticity of demand for

Q80: In the following graph the price of