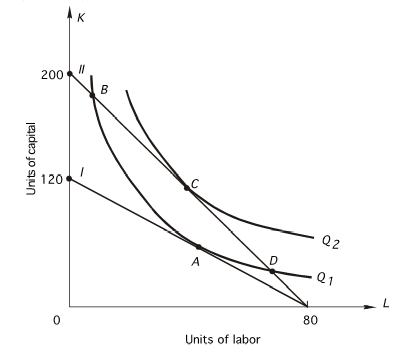

In the above graph,the shift from I to II was due to

In the above graph,the shift from I to II was due to

Definitions:

MACRS Tables

The Modified Accelerated Cost Recovery System tables used in the United States for tax purposes to determine the depreciation of assets over time.

Allowable Depreciation

The allowable tax deduction for the reduction in value of a tangible asset over its useful life, as determined by tax regulations.

MACRS Tables

Depreciation schedules in the Modified Accelerated Cost Recovery System allowing for faster asset depreciation in the earlier years of the asset's life.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life.

Q2: The total cost schedule for a

Q18: According to the above figure,what are

Q23: A second-mover advantage<br>A)exists when a firm can

Q23: Refer to the following table that

Q24: Refer to the following graph to answer

Q46: A firm produces 4,000 units of output

Q47: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7882/.jpg" alt=" Above is a

Q54: For a price-taking firm,marginal revenue<br>A)is the addition

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7882/.jpg" alt=" Given the above

Q77: The following graph shows the marginal and