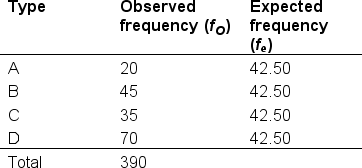

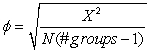

Calculate Cramér's for the following data:  Use the following formula:

Use the following formula:

Definitions:

Black-Scholes

A mathematical model used for pricing European style options and understanding the dynamics of options markets.

Standard Deviation

Standard Deviation is a statistical measurement that represents the degree of variation or dispersion from the average, often used to quantify the risk of investment returns.

Market Call Premium

Additional amount above the par value that an investor must pay to call in a callable bond before its maturity date.

Stock Price Volatility

Refers to the degree of variation of a trading price series over time as measured by the standard deviation of logarithmic returns.

Q1: In linear regression, the Y-intercept a is

Q2: Behavioral assessment usually relies on multiple methods

Q13: Despite Freud's influence on Adler, there are

Q37: Albert Ellis argues that humans tend to

Q38: For <span class="ql-formula" data-value="\chi"><span class="katex"><span

Q40: A researcher hypothesizes that people living in

Q56: Which of these is NOT one of

Q88: For a sample of 100 students analyzing

Q104: What is the expected frequency (f<sub>e</sub>) for

Q114: For a sample of 125, a