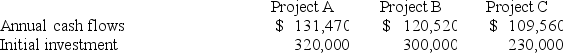

Norwood,Inc. ,which has a hurdle rate of 12%,is considering three different independent investment opportunities.Each project has a seven-year life.The annual cash flows and initial investment for each of the projects are as follows:

a.What is the present value of the annual cash flows for each of the three projects?

a.What is the present value of the annual cash flows for each of the three projects?

b.What is the net present value of each of the projects?

c.What is the profitability index of each of the projects? (Round to two decimal places. )

d.In what order should Norwood prioritize investment in the projects?

Definitions:

Economies of Scale

Cost advantages that enterprises obtain due to their scale of operation, with cost per unit of output decreasing with increasing scale.

Inelastic Resource Supply

A condition where the supply of a resource does not significantly change in response to price changes.

Total Variable Costs

The sum of all costs that vary with the level of output or production, such as materials and labor, as opposed to fixed costs which remain constant regardless of the level of production.

Average Fixed Cost

The steady costs associated with production, irrespective of output volume, divided by the number of units produced.

Q41: When managers make a decision,they base it

Q43: A times interest earned ratio of 11

Q46: Fargo Corp.is considering the purchase of a

Q47: A standard cost system records costs at

Q48: Jackson Inc.produces leather handbags.The production budget for

Q52: The following information pertains to Chestnut,Inc.: <img

Q87: Ratio analysis:<br>A)is required by GAAP as part

Q109: Major Corp.is considering the purchase of a

Q128: Hamilton,Inc.has two divisions,Parker and Blaine.Following is the

Q140: Which of the following ratios is a