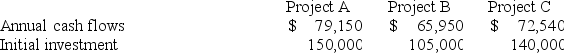

Iron,Inc. ,which has a hurdle rate of 10%,is considering three different independent investment opportunities.Each project has a five-year life.The annual cash flows and initial investment for each of the projects are as follows: (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. ) (Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )  In what order should Iron prioritize investment in the projects?

In what order should Iron prioritize investment in the projects?

Definitions:

Consumer Surplus

The variance between the sum consumers are inclined and can afford to pay for a good or service and the sum they genuinely pay.

Producer Surplus

Producer surplus is the difference between what producers are willing to sell a good for and the actual price they receive.

Total Surplus

The sum of consumer surplus and producer surplus in a market, representing the total benefits to society from the trading of goods or services.

Equilibrium Price

The market price at which the quantity of a good demanded equals the quantity supplied, leading to a stable market condition.

Q17: Describe what Aristotle believes is the relationship

Q20: Which of these are liquidity ratios?<br>A)Net profit

Q24: When the direct method is used to

Q53: Tulip Inc.uses standard costing,and its manufacturing standards

Q68: Ian operates an automobile repair shop and

Q72: Condensed financial data of Monopoly Corporation appear

Q87: Standard cost systems depend on which two

Q95: Grover has forecast sales to be $125,000

Q95: Which of the following statements about the

Q196: Which of the following would be included