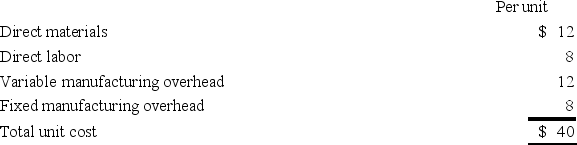

Olive Corp.currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are:  An outside supplier has offered to provide Olive Corp.with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp.accepts the outside offer,what will be the effect on short-term profits?

An outside supplier has offered to provide Olive Corp.with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp.accepts the outside offer,what will be the effect on short-term profits?

Definitions:

Homemade Dividend Policies

Investment strategies whereby investors create their own dividend stream by selling a portion of their portfolio of equities.

Stockholders

Individuals or entities that own shares in a corporation, thereby having partial ownership and potentially receiving dividends.

Dividend Payout

The portion of a company's earnings distributed to shareholders, typically in the form of cash or additional shares.

Future Dividend

The dividends that a company expects to declare and pay to shareholders in upcoming periods, based on future earnings projections.

Q8: Dobson Corp.is considering the purchase of a

Q17: Carter,Inc.uses a traditional volume-based costing system in

Q71: Jupiter Co.applies overhead based on direct labor

Q92: Cloud Corp.is considering the purchase of a

Q92: Which of the following is not a

Q111: A scattergraph is useful in recognizing unusual

Q112: Which of the following is not a

Q121: The number of units included in the

Q128: Jackson,Inc.produces two different products (Product 5 and

Q136: Olive Corp.currently makes 20,000 subcomponents a year