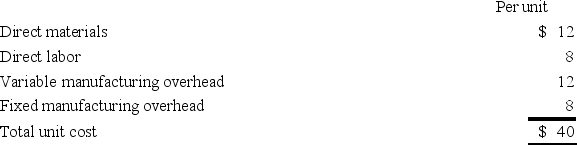

Olive Corp.currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are:  An outside supplier has offered to provide Olive Corp.with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp.rejects the outside offer,what will be the effect on short-term profits?

An outside supplier has offered to provide Olive Corp.with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp.rejects the outside offer,what will be the effect on short-term profits?

Definitions:

Expected Rate

In finance, it refers to the return anticipated on an investment or the interest rate at which money is borrowed or lent.

Risk-Free Asset

An investment that is expected to deliver guaranteed returns with no risk of financial loss.

Expected Rate

A projection or estimate of the rate of return on an investment or the growth rate of an economic variable in the future.

Standard Deviation

A statistical metric that quantifies the spread or variability among a collection of values, representing the extent of dispersion within the data set.

Q43: Which of the following statements best represents

Q53: Lynwood,Inc.produces two different products (Product A and

Q53: Frank Inc.is trying to decide whether to

Q62: Irwin Corp.has fixed costs of $20,000 and

Q65: Which of the following best defines a

Q72: Swan Company has a direct labor standard

Q86: Elm uses the high-low method of estimating

Q111: Comparing the master budget with the flexible

Q120: Spencer Inc.manufactures a product that costs $36

Q128: Hamilton,Inc.has two divisions,Parker and Blaine.Following is the