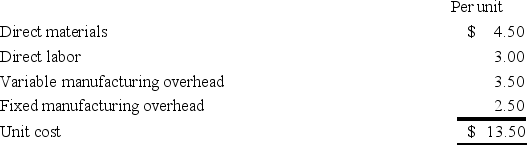

Deer currently manufactures a subcomponent that is used in its main product.A supplier has offered to supply all the subcomponents needed at a price of $12.Deer currently produces 80,000 subcomponents at the following manufacturing costs:

a.If Deer has no alternative uses for the manufacturing capacity,what would be the profit impact of buying the subcomponents from the supplier?

a.If Deer has no alternative uses for the manufacturing capacity,what would be the profit impact of buying the subcomponents from the supplier?

b.If Deer has no alternative uses for the manufacturing capacity,what would be the maximum price per unit they would be willing to pay the supplier?

c.Now assume Deer would avoid $120,000 in equipment leases and salaries if the subcomponent were purchased from the supplier.Now what would be the profit impact of buying from the supplier?

Definitions:

Exchange Gain

A financial gain resulting from a favorable change in exchange rates affecting the value of foreign-currency-denominated assets or liabilities.

Current-Rate Method

A method used in translating the financial statements of foreign subsidiaries, where all assets and liabilities are translated at the current exchange rate.

Retained Earnings

The portion of a company's profit that is held or retained and not paid out as dividends to shareholders, often used for investment in the business, debt reduction, or to shore up the balance sheet.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, obsolescence, or a decline in value.

Q37: Campbell,Inc.sold 100,000 units last year for $2.00

Q48: Jackson Inc.produces leather handbags.The production budget for

Q60: Which of the following is the best

Q65: Which of the following is not a

Q89: Contribution margin is equal to fixed costs

Q90: The responsibility center in which the manager

Q108: The profit equation is:<br>A)(Unit price × Q)-

Q112: Swan Company has a direct labor standard

Q117: Estate has an ROI of 16% based

Q126: Budgeted manufacturing overhead includes indirect manufacturing costs,but