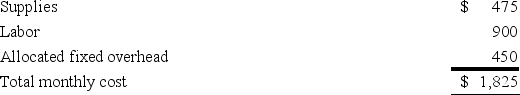

Moss,Inc.currently processes payroll in its accounting department,which costs the following per month:  Moss could use a payroll processing firm instead,which would cost $1,350 per month,but the firm would provide all supplies.If Moss used the outside firm,the accountants who currently process payroll would be reassigned to other accounting tasks.How much would monthly costs be affected if Moss switched to the payroll processing firm?

Moss could use a payroll processing firm instead,which would cost $1,350 per month,but the firm would provide all supplies.If Moss used the outside firm,the accountants who currently process payroll would be reassigned to other accounting tasks.How much would monthly costs be affected if Moss switched to the payroll processing firm?

Definitions:

Specific Invoice Method

A method used in inventory and cost accounting to specifically track the cost associated with individual inventory items.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including material and labor expenses.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated by adding new purchases to beginning inventory and subtracting costs of goods sold.

Inventory Valuation Method

The approach used to calculate the cost of inventory that a business has sold or currently holds, influencing financial reporting and tax calculations.

Q3: Maggie Corp.has a selling price of $20

Q3: Dade Corp.has residual income of $10,000.If operating

Q26: Mindy Corp.is considering the purchase of a

Q79: Carmen,Inc.is considering three different independent investment opportunities.The

Q94: Palm Inc.has a profit margin of 15%

Q96: Benjamin Inc.uses a standard cost system and

Q108: Conversion costs consist of:<br>A)all costs of production.<br>B)raw

Q110: Managers can use cost-volume-profit analysis to evaluate

Q114: Crest Products expects the following sales of

Q121: Indigo Corp.has an ROI of 15% and