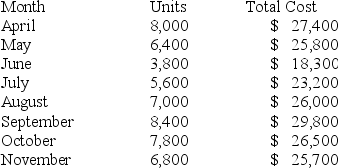

Silver Products has presented the following information for the past eight months operations:

a.Using the high-low method,calculate the fixed cost per month and variable cost per unit.

a.Using the high-low method,calculate the fixed cost per month and variable cost per unit.

b.What would total costs be for a month with 5,000 units produced?

Definitions:

GAAP

Generally Accepted Accounting Principles, a common set of accounting rules and standards for financial reporting in the United States.

Pledging

The act of providing assets as security or collateral for a debt.

Assignment

A task or piece of work allocated to someone as part of a job or course of study.

Allowance Method

An accounting method for estimating uncollectible accounts receivable that involves creating a provision for bad debts as a percentage of the accounts receivable.

Q9: Manufacturing firms prepare a separate direct materials

Q27: Garfield Personal Training Services is owned by

Q29: Yallow,Inc.manufactures teddy bears and dolls.Currently,Yallow makes 2,000

Q30: Top-down budgeting is:<br>A)when the local managers impose

Q31: The first step in ABC is:<br>A)to calculate

Q56: All the costs assigned to an individual

Q114: When Carter,Inc.sells 48,000 units,its total variable cost

Q124: Manufacturing overhead was estimated to be $400,000

Q127: Heathcoat Co.uses process costing to account for

Q134: It costs Camp,Inc.$35 per unit to manufacture