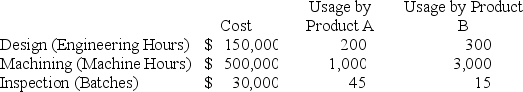

Walnut Systems produces two different products,Product A,which sells for $120 per unit,and Product B,which sells for $180 per unit,using three different activities: Design,which uses Engineering Hours as an activity driver;Machining,which uses machine hours as an activity driver;and Inspection,which uses number of batches as an activity driver.The cost of each activity and usage of the activity drivers are as follows:

Walnut manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $50 of direct materials and $20 of direct labor,while each unit of Product B uses $75 of direct materials and $35 of direct labor.

Walnut manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $50 of direct materials and $20 of direct labor,while each unit of Product B uses $75 of direct materials and $35 of direct labor.

Required:

a.Calculate the activity rate for Design.

b.Calculate the activity rate for Machining.

c.Calculate the activity rate for Inspection.

d.Determine the indirect costs assigned to Product A.

e.Determine the indirect costs assigned to Product B.

f.Determine the manufacturing cost per unit for Product A.

g.Determine the manufacturing cost per unit for Product B.

h.Determine the gross profit per unit for Product A.

i.Determine the gross profit per unit for Product B.

Definitions:

Notation

A system of symbols or marks used for representing information, especially in mathematical or musical contexts.

Financing Statement

A document filed to give public notice of a secured party's interest in the debtor's personal property, used in the U.S. under the Uniform Commercial Code.

Certificate of Title

An official document indicating ownership of property, such as real estate or a vehicle.

Perfect

To complete or make flawless; often used in legal contexts to denote the finalization of a right or claim.

Q19: Which of the following accounts will be

Q25: Imagine purchasing a cup of coffee.Which of

Q30: The journal entry to record the completion

Q66: When disposed of,overapplied manufacturing overhead will:<br>A)increase Cost

Q74: Which of the following costs is not

Q74: Graham Corp.sells two products.Product A sells for

Q77: Raul noticed that when he saw other

Q83: Which of the following statements is correct

Q83: Santos Inc.had the following information for the

Q84: The manager of Arbor,Inc.is considering raising its