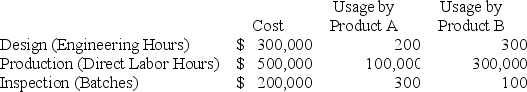

Carter,Inc.produces two different products,Product A and Product B.Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base.Carter is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Design,Production,and Inspection.The cost of each activity and usage of the activity drivers are as follows:

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Design.

c.Calculate the activity rate for Machining.

d.Calculate the activity rate for Inspection.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system.

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Chart of Accounts

A systematic listing of all accounts used by an organization, categorized to facilitate financial reporting and bookkeeping.

GAAP

Generally Accepted Accounting Principles, the standard framework of guidelines for financial accounting in the U.S.

Income Statement Accounts

The accounts that report the revenues, expenses, gains, and losses of a company, which are used to calculate the net income on the income statement.

Trial Balance

A bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account columns to check for accuracy.

Q2: Which of the following is not another

Q11: Merlot,Inc.has fixed costs of $200,000,sales price of

Q15: Managers of small,private corporations use managerial accounting

Q26: The high-low method provides a reasonable estimate

Q32: Alameda Manufacturing manufactures a variety of wooden

Q35: Reno Corp.produces three products,and is currently facing

Q44: A firm with a higher degree of

Q65: Jasmine Corp.has a selling price of $15,variable

Q118: Maple Inc.manufactures a product that costs $45

Q126: The approach to cost management that calls