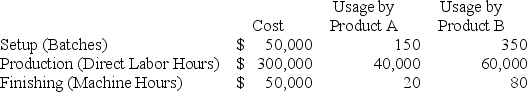

Harwell,Inc.produces two different products,Product A and Product B.Harwell uses a traditional volume-based costing system in which direct labor hours are the allocation base.Harwell is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Setup,Production,and Finishing.The cost of each activity and usage of the activity drivers are as follows:

Harwell manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Harwell manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Setup.

c.Calculate the activity rate for Production.

d.Calculate the activity rate for Finishing.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Behavioral Therapy

Therapy that focuses on changing a person’s specific behaviors by replacing unwanted behaviors with desired behaviors.

Food Intake

Refers to the consumption of food and beverages by an individual or organism.

Avoided Foods

Foods that individuals choose not to eat for various reasons including allergies, health conditions, ethical beliefs, or personal preferences.

Cognitive-Behavioral Therapy (CBT)

A form of psychotherapy that focuses on modifying dysfunctional emotions, behaviors, and thoughts through a goal-oriented, systematic procedure.

Q16: Brody Corp.uses a process costing system.Beginning inventory

Q17: Which of the following is a mixed

Q21: Prevention costs are incurred to prevent quality

Q25: Star,Inc.used Excel to run a least-squares regression

Q43: The importance of physical appearance<br>A) is less

Q48: All else being equal,if sales revenue doubles,fixed

Q58: Elektra Enterprises manufactures custom boat covers.For each

Q62: Mariposa Manufacturing builds custom wooden cabinets.Mariposa Manufacturing

Q80: Hadley,Inc.manufactures a product that uses $15 in

Q130: Heathcoat Co.uses process costing to account for