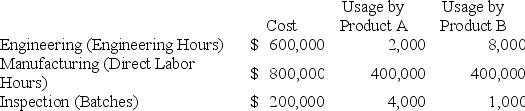

Hayden,Inc.produces two different products,Product A and Product B.Hayden uses a traditional volume-based costing system in which direct labor hours are the allocation base.Hayden is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Engineering,Manufacturing,and Inspection.The cost of each activity and usage of the activity drivers are as follows:

Hayden manufactures 10,000 units of Product A and 5,000 units of Product B per month.

Hayden manufactures 10,000 units of Product A and 5,000 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Engineering.

c.Calculate the activity rate for Manufacturing.

d.Calculate the activity rate for Inspection.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system.

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Common Reactions

General or typical responses or behaviors in specific situations or under stress.

Victimization

The process or state of being subjected to harm, oppression, or mistreatment by another individual or group.

Depression

A mental health disorder characterized by persistent feelings of sadness, hopelessness, and a lack of interest or pleasure in activities.

Interracial

Pertaining to relationships or marriages between people of different racial backgrounds.

Q23: Pepper Corp.produces three products,and currently has a

Q42: When materials are placed into production:<br>A)Raw Materials

Q68: Which of the following is not a

Q74: Elmwood Company has identified seven activities as

Q85: Hair salons and law firms are examples

Q88: All of the following terms are often

Q91: Hamilton,Inc.manufactures units in two processes: Production and

Q92: Braden Corp.uses a process costing system.Beginning inventory

Q109: Cost per equivalent unit is calculated separately

Q115: Halifax Products sells a product for $75.Variable