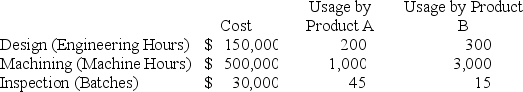

Walnut Systems produces two different products,Product A,which sells for $120 per unit,and Product B,which sells for $180 per unit,using three different activities: Design,which uses Engineering Hours as an activity driver;Machining,which uses machine hours as an activity driver;and Inspection,which uses number of batches as an activity driver.The cost of each activity and usage of the activity drivers are as follows:

Walnut manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $50 of direct materials and $20 of direct labor,while each unit of Product B uses $75 of direct materials and $35 of direct labor.

Walnut manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $50 of direct materials and $20 of direct labor,while each unit of Product B uses $75 of direct materials and $35 of direct labor.

Required:

a.Calculate the activity rate for Design.

b.Calculate the activity rate for Machining.

c.Calculate the activity rate for Inspection.

d.Determine the indirect costs assigned to Product A.

e.Determine the indirect costs assigned to Product B.

f.Determine the manufacturing cost per unit for Product A.

g.Determine the manufacturing cost per unit for Product B.

h.Determine the gross profit per unit for Product A.

i.Determine the gross profit per unit for Product B.

Definitions:

Automatic Stabilizers

Financial policies and schemes intended to balance out variations in a country's economic performance, avoiding extra government or policymaker involvement.

Legislative Action

The process by which laws are created, amended, or repealed within a legislative body such as a parliament or congress.

Macroeconomic Activity

The total economic activities and interactions at a national or global level, including production, consumption, saving, and investment.

Nondiscretionary Fiscal Policy

Government policies related to taxation and spending that automatically adjust without the need for explicit action by policy makers.

Q4: Trout,Inc.prepared the following production report:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7948/.jpg"

Q13: A relevant cost is a cost that:<br>A)has

Q14: Idaho Corp.has fixed costs of $20,000 and

Q54: Marvin is 36 and the cutoff for

Q55: Sherman,Inc.manufactures chainsaws that sell for $58.Each chainsaw

Q55: Which of the following represents the accumulated

Q84: The manager of Arbor,Inc.is considering raising its

Q129: Washington,Inc.produces two different products (Product C and

Q131: Process costing often combines direct materials and

Q139: Melinda's Custom Homes,a construction company that builds