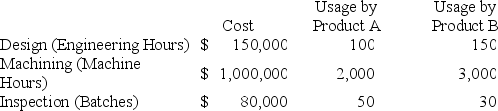

Atlanta Systems produces two different products,Product A,which sells for $250 per unit,and Product B,which sells for $400 per unit,using three different activities: Design,which uses Engineering Hours as an activity driver;Machining,which uses machine hours as an activity driver;and Inspection,which uses number of batches as an activity driver.The cost of each activity and usage of the activity drivers are as follows:

Atlanta manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $100 of direct materials and $45 of direct labor,while each unit of Product B uses $140 of direct materials and $75 of direct labor.

Atlanta manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $100 of direct materials and $45 of direct labor,while each unit of Product B uses $140 of direct materials and $75 of direct labor.

Required:

a.Calculate the activity rate for Design.

b.Calculate the activity rate for Machining.

c.Calculate the activity rate for Inspection.

d.Determine the indirect costs assigned to Product A.

e.Determine the indirect costs assigned to Product B.

f.Determine the manufacturing cost per unit for Product A.

g.Determine the manufacturing cost per unit for Product B.

h.Determine the gross profit per unit for Product A.

i.Determine the gross profit per unit for Product B.

Definitions:

Schedule M-1

is a tax form used by corporations to reconcile income reported on tax returns with income reported on financial statements.

Alternative Minimum Tax

A parallel tax system to the regular income tax that ensures that certain taxpayers pay at least a minimum amount of tax.

Corporations

Legal entities that are separate from their owners, capable of owning property, entering contracts, and being taxed.

Subject

A broad term typically referring to the main topic or person being discussed or studied.

Q5: Which of the following is not a

Q21: Elmwood,Inc.currently sells 12,000 units of its product

Q49: Jerome Corp.has fixed costs of $500,000 and

Q67: Robin Company has the following balances for

Q76: Managers can use cost-volume-profit analysis to help

Q95: To earn summer money,Joe could mow lawns

Q96: A cost that changes,in total,in direct proportion

Q106: When intimacy,passion,and commitment exist,the relationship is said

Q106: The term "Big data" refers to the

Q128: Hamilton,Inc.has two divisions,Parker and Blaine.Following is the