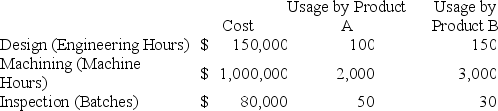

Atlanta Systems produces two different products,Product A,which sells for $250 per unit,and Product B,which sells for $400 per unit,using three different activities: Design,which uses Engineering Hours as an activity driver;Machining,which uses machine hours as an activity driver;and Inspection,which uses number of batches as an activity driver.The cost of each activity and usage of the activity drivers are as follows:

Atlanta manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $100 of direct materials and $45 of direct labor,while each unit of Product B uses $140 of direct materials and $75 of direct labor.

Atlanta manufactures 10,000 units of Product A and 7,500 units of Product B per month.Each unit of Product A uses $100 of direct materials and $45 of direct labor,while each unit of Product B uses $140 of direct materials and $75 of direct labor.

Required:

a.Calculate the Design activity proportions for Products A and B.

b.Calculate the Machining activity proportions for Products A and B.

c.Calculate the Inspection activity proportions for Products A and B.

d.Determine the indirect costs assigned to Product A.

e.Determine the indirect costs assigned to Product B.

f.Determine the manufacturing cost per unit for Product A.

g.Determine the manufacturing cost per unit for Product B.

h.Determine the gross profit per unit for Product A.

i.Determine the gross profit per unit for Product B.

Definitions:

Interest Payable

Interest payable is the amount of interest expense that has been incurred but not yet paid by a borrower as of a specific date.

Annual Interest

The total amount of interest paid or earned over a one-year period, commonly associated with loans, savings, and investments.

Adjusting Entry

A transaction recorded in accounting to revise account balances at the end of an accounting cycle.

Financial Statements

Consolidated documents that track and report an entity's financial performance and health, including balance sheet, income statement, and cash flow statement.

Q25: Star,Inc.used Excel to run a least-squares regression

Q28: Frontier Corp.sells units for $50,has unit variable

Q34: Prevention costs are costs that:<br>A)are incurred to

Q53: Lynwood,Inc.produces two different products (Product A and

Q66: When disposed of,overapplied manufacturing overhead will:<br>A)increase Cost

Q90: Calverton,Inc.produces two different products (Standard and Luxury)using

Q97: Harwell,Inc.produces two different products,Product A and Product

Q106: Consider a winery that employs eight people

Q116: To determine the number of units needed

Q133: What is the term for the most