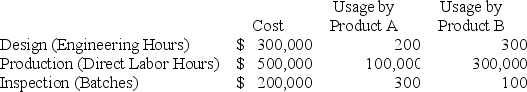

Carter,Inc.produces two different products,Product A and Product B.Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base.Carter is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Design,Production,and Inspection.The cost of each activity and usage of the activity drivers are as follows:

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Design.

c.Calculate the activity rate for Machining.

d.Calculate the activity rate for Inspection.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system.

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

NSF Check

A cheque that has been returned by the bank because the account on which it was drawn did not have sufficient funds, stands for Non-Sufficient Funds.

Bank Errors

Mistakes made by a bank in the processing of transactions, which can include errors in deposits, withdrawals, or charges that affect account balances.

Adjusting Entry

Journal entries made at the end of an accounting period to allocate revenues and expenses to the period in which they actually occurred.

NSF Check

A Non-Sufficient Funds (NSF) check is a check that cannot be processed because the account it is drawn on does not have enough funds.

Q7: Manufacturing overhead was estimated to be $250,000

Q12: Last month Empire Company had a $30,000

Q35: Which of the following are factors in

Q71: Sonora,Inc.is launching a new product that it

Q78: Which of the following statements concerning costs

Q79: Russo Cabinets is a custom cabinet builder.They

Q83: All else being equal,what happens to the

Q84: Parkside Rentals,a firm that rents tuxedos for

Q90: To determine how much cost should be

Q109: Heather Inc has the following information for