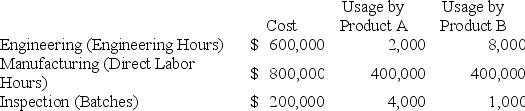

Hayden,Inc.produces two different products,Product A and Product B.Hayden uses a traditional volume-based costing system in which direct labor hours are the allocation base.Hayden is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Engineering,Manufacturing,and Inspection.The cost of each activity and usage of the activity drivers are as follows:

Hayden manufactures 10,000 units of Product A and 5,000 units of Product B per month.

Hayden manufactures 10,000 units of Product A and 5,000 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Engineering.

c.Calculate the activity rate for Manufacturing.

d.Calculate the activity rate for Inspection.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system.

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Expected Dividend

The forecasted payment of dividends to shareholders based on the company's past dividends and future earnings projections.

Per Share

A term used to describe a financial ratio or statistic as it relates to one individual share of stock.

Annual Dividends

The total amount of dividend payments a company pays out to its shareholders in one year.

Desired Rate of Return

The minimum return an investor expects to achieve by investing in a particular asset, taking into account the asset's risk level.

Q18: Ace Architects employs two architects,each having a

Q21: For units that are completed and transferred

Q22: Georgia uses the high-low method of estimating

Q26: A predetermined overhead rate is calculated by

Q48: GG's Personal Training Services is owned by

Q68: Ecola Company uses a job order costing

Q71: Sonora,Inc.is launching a new product that it

Q113: A direct cost is one that:<br>A)involves an

Q123: Stangol Co.uses process costing to account for

Q134: Parkside Rentals,a firm that rents tuxedos for