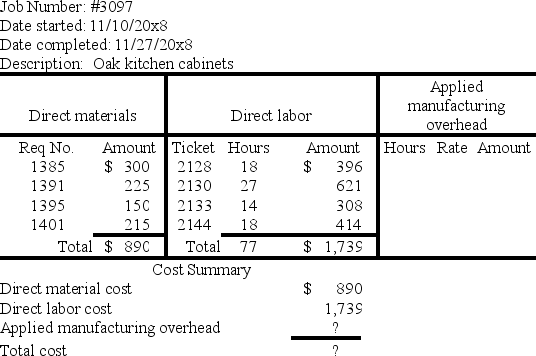

Belton Custom Kitchens is a custom cabinet builder.They recently completed a set of kitchen cabinets (Job Number 3097),as summarized below:

Belton applies overhead to jobs at a rate of $17 per direct labor hour.

Belton applies overhead to jobs at a rate of $17 per direct labor hour.

a.How much overhead would be applied to Job #3097?

b.What is the total cost of Job #3097?

Definitions:

FICA Taxes

Federal Insurance Contributions Act taxes, which are payroll taxes in the United States used to fund Social Security and Medicare programs.

Payroll Deductions

Deductions from gross earnings to determine the amount of a paycheck.

Supervisors

Individuals who oversee the work of others, ensuring tasks are completed efficiently and effectively within a company or department.

Notes Payable

A liability on a company's balance sheet representing amounts owed to creditors or banks, typically due for payment within one year or less.

Q9: In an international Internet survey,Lippa found<br>A) that

Q30: Cardinal uses the high-low method of estimating

Q52: To assign activity costs using the activity

Q54: Marvin is 36 and the cutoff for

Q93: During the process of friendship repair,the offender<br>A)

Q95: To earn summer money,Joe could mow lawns

Q99: McNeil uses the high-low method of estimating

Q102: _ is the tendency to explain other

Q109: Lance's class was upset with Arthur's class

Q115: Kramer Corp.began the current period with 4,000