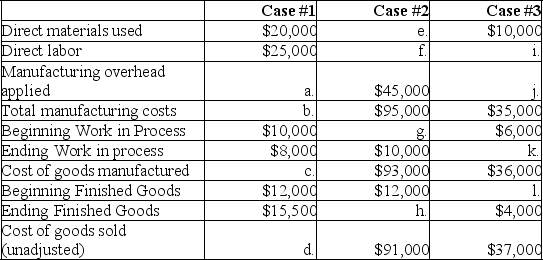

Deer Lake Inc.uses a job order costing system with manufacturing overhead applied to products at a rate of 150% of direct labor cost.Treating each case independently,find the missing amounts for a through l:

Definitions:

Deferred Tax Liability

A tax obligation that arises from temporary differences between accounting and tax calculations, to be paid in the future.

Unearned Revenue

This is income received by a business for goods or services yet to be delivered or performed. It's considered a liability until the product or service is delivered.

Cash Payment

A transaction in which a payment is made using physical currency or through a digital cash transfer rather than credit.

Deferred Tax Asset

An asset on a company's balance sheet that may be used to reduce future tax liability; it arises when a company has overpaid taxes or paid them in advance.

Q48: All else being equal,if sales revenue doubles,fixed

Q60: When someone approaches close to you in

Q75: The method of communication that conveys emotions

Q87: An increase in positive feelings toward a

Q91: Calverton,Inc.produces two different products (Standard and Luxury)using

Q93: What is the difference between full absorption

Q98: Island Enterprises has presented the following information

Q105: The expectation that marriage will fill diverse

Q117: People who are preoccupied with themselves seem

Q124: Manufacturing overhead was estimated to be $400,000