Curtis Inc.uses a job order costing system.Manufacturing overhead is applied on the basis of direct labor cost.Total manufacturing overhead was estimated to be $75,000 for the year;direct labor was estimated to total $150,000.

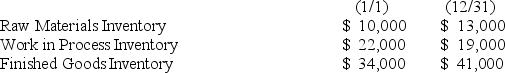

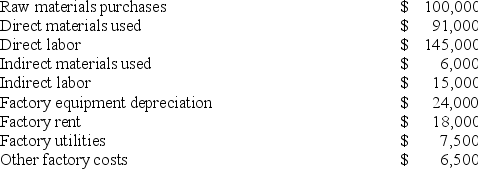

The following transactions have occurred during the year.

The following transactions have occurred during the year.

a.Calculate the predetermined overhead rate.

a.Calculate the predetermined overhead rate.

b.Calculate cost of goods manufactured.

c.Calculate the over- or underapplied overhead.

d.Calculate adjusted cost of goods sold.

Definitions:

Incremental Cash Inflow

Additional cash received as a result of undertaking an investment or project.

Net 30 Credit Policy

A payment term that indicates that the payment for goods or services is due 30 days from the invoice date.

Monthly Interest Rate

The interest rate applied to a loan or debt for a one-month period.

Q1: The cost of quality training is an

Q19: Janet noticed that Craig was forgetting to

Q32: _ is defined as an interactional process

Q59: _ occurs when a person has fewer

Q75: Which of the following cannot be an

Q97: An irrelevant cost:<br>A)is also called a differential

Q102: All manufacturing costs are treated as product

Q115: Research supports which of the following statements

Q120: Explain why collaboration is considered the most

Q120: Which of the following statements is correct