Use the information below to answer the following questions.

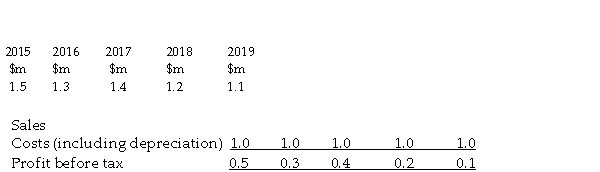

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750,000 and have a life of 5 years and a nil residual value. It will be ready for operation on 31 December 2014. The following income statement figures for the new binoculars are forecast:  Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The annual cash outflow for the project is:

Definitions:

Tax Rate

The rate at which a person or business is taxed by the government.

Tax Proration

The division or allocation of taxes between parties (such as buyers and sellers) based on their period of ownership or usage.

Annual Tax Bill

The total amount of tax owed by an individual or corporation in a given fiscal year.

Taxable Income

The amount of income that is used to calculate how much tax an individual or a company owes to the government.

Q2: The heartbeat begins in the AV node.

Q7: Under the realisation convention, income is regarded

Q21: The statement about current value that is

Q22: If a company issues 20,000 ordinary shares

Q30: These statements are all correct except:<br>A) It

Q53: In evaluating projected financial statements, which key

Q55: The principle whereby each partner is responsible

Q60: Relevant cash flows for investment decisions are:<br>A)

Q63: Under accrual accounting, profit is measured as:<br>A)

Q117: Ischemia<br>A)Fainting<br>B)Paleness of skin<br>C)Air hunger<br>D)Paralysis of one limb