Use the information below to answer the following questions.

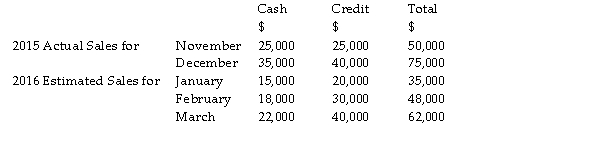

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2015 and planned sales for the first quarter of 2016.  Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

Past records indicate that expected receipts collected from debtors will be: 60 per cent in the month of sale

40 per cent in the month following the sale

-If units sales of the iPad are currently 5,000 units, and those of the Macbook Air are currently double those of the iPad, what will the company's total sales forecast be if sales of the iPad increase by 10 per cent and those of the Macbook Air go up by 2,000 units?

Definitions:

Labor Intensive

A process or industry that requires a large amount of human labor compared to capital investment.

Fixed Asset Turnover Ratio

A financial ratio that measures a company's efficiency in using its fixed assets to generate sales, calculated by dividing net sales by the net value of fixed assets.

Book Value

The net value of a company's assets found on its balance sheet, calculated as total assets minus intangible assets and liabilities.

Accumulated Depreciation

The total depreciation charged over an asset's life, reducing its book value.

Q15: In the accounting equation, claims on the

Q17: Choose the statement about depreciation that is

Q25: Cardiomegaly is a softening of the heart

Q25: The current market price of a company's

Q46: What is a bleeding disorder characterized by

Q51: Identify the asset.<br>A) loan from ABC Ltd.<br>B)

Q56: Which of these is an advantage of

Q73: Inflammation and the formation of a clot

Q130: The combining form for the armpit is

Q179: The area of the chest wall anterior