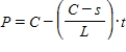

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $8,100 and has a scrap value of $2,100 after 10 years, write an equation to represent the present value after t years.

Definitions:

Earnings

The financial gains obtained from labor, investment, or business operations, typically measured over specific periods.

Applicants

Individuals who apply or express interest in a job, program, or opportunity, seeking to become candidates for selection.

HRISs

Human Resource Information Systems, digital solutions for managing an organization's people-related data and processes.

Technological Effect

The impact of technology on society, including changes in behaviour, efficiency, and economic structures.

Q3: Identify the curve. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Identify

Q10: The Thompson Company manufactures two industrial products,

Q31: Find the seven pattern. <br>A) 7, 5,

Q44: Use the properties of logarithms to write

Q46: Solve the system by the addition method.<br>

Q63: The ages of the runners in a

Q74: Let R, F, L, B, T, U

Q75: Suppose Ingredient I is made up of

Q92: Suppose your gross monthly income is $6,500

Q104: Determine whether the argument in the problem