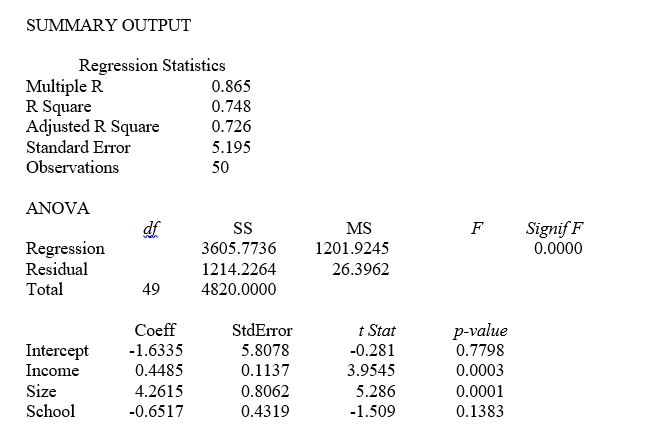

TABLE 14-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 14-4, at the 0.01 level of significance, what conclusion should the builder draw regarding the inclusion of School in the regression model?

Definitions:

Failure to File

The failure of an individual or business to submit their tax return by the due date, which can result in penalties and interest charges.

Qualifying Widow(er)

A tax filing status allowing a widowed spouse to use married filing jointly tax rates for up to two years after the year of their spouse's death, provided they have a dependent child.

Qualifying Child

A dependent who meets specific IRS criteria regarding relationship, age, residency, and support, which allows the taxpayer to claim certain tax benefits.

Tax Return

A document filed with a tax authority that reports income, expenses, and other pertinent tax information.

Q22: Referring to Table 17-10, a c chart

Q22: The use of preservatives by food processors

Q31: Referring to Table 14-11, in terms of

Q36: Referring to Table 12-5, if the firm

Q55: Referring to Table 12-9, what is the

Q60: Referring to Table 13-12, the error sum

Q70: A high value of R<sup>2</sup> significantly above

Q115: After estimating a trend model for annual

Q119: Referring to Table 14-5, what is the

Q132: Referring to Table 16-3, if this series