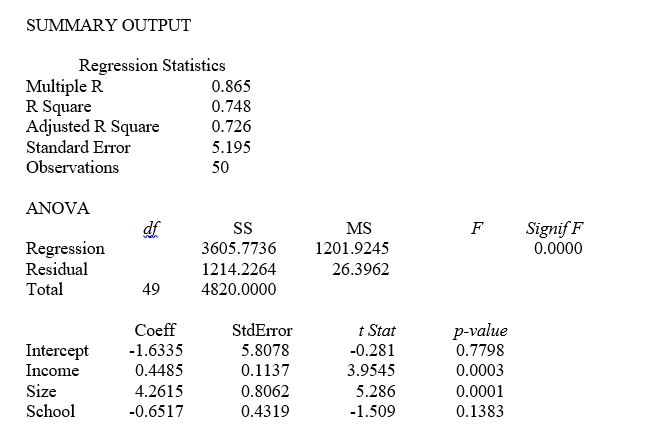

TABLE 14-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) , family size (Size) , and education of the head of household (School) . House size is measured in hundreds of square feet, income is measured in thousands of dollars, and education is in years. The builder randomly selected 50 families and ran the multiple regression. Microsoft Excel output is provided below:

-Referring to Table 14-4, what are the regression degrees of freedom that are missing from the output?

Definitions:

Preferred Stock

A class of stock that carries with it the right to receive payment of dividends and/or the distribution of assets on the dissolution of the corporation before other classes of stock receive their payments.

Dividends

Net profits, or surplus, set aside for shareholders.

Dissolution

A change in the relation of partners caused by any partner ceasing to be associated in the carrying on of the business.

Limited Liability Company

A business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Q13: Referring to Table 14-13, the predicted demand

Q16: The superintendent of a school district wanted

Q24: Referring to Table 12-12, if there is

Q60: The fairly regular fluctuations that occur within

Q108: Referring to Table 17-10, based on the

Q128: Referring to Table 16-6, a centered 5-year

Q144: Referring to Table 12-4, find the rejection

Q157: The strength of the linear relationship between

Q196: Referring to Table 13-5, the standard error

Q203: When an explanatory variable is dropped from