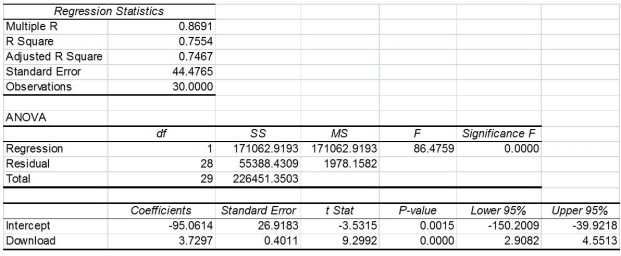

TABLE 13-11

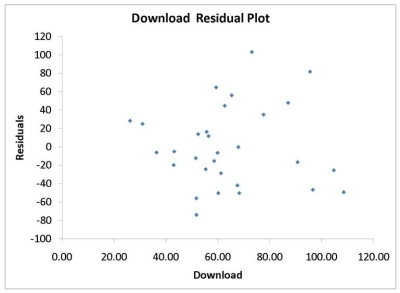

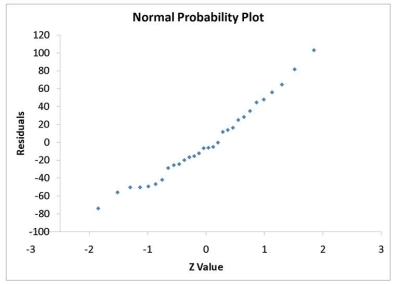

A computer software developer would like to use the number of downloads (in thousands) for the trial version of his new shareware to predict the amount of revenue (in thousands of dollars) he can make on the full version of the new shareware. Following is the output from a simple linear regression along with the residual plot and normal probability plot obtained from a data set of 30 different sharewares that he has developed:

-Referring to Table 13-11, what is the p-value for testing whether there is a linear relationship between revenue and the number of downloads at a 5% level of significance?

Definitions:

Well-Diversified Portfolios

Investment portfolios that are spread across various assets to minimize exposure to any single asset or risk.

Arbitrage Opportunities

Situations in which it is possible to simultaneously buy and sell an asset or assets to profit from a difference in prices across different markets or formats without risk.

Expected Excess Return

The return on an investment over the risk-free rate of return that is anticipated based on risk assessment.

Q2: Referring to Table 14-6, the estimated value

Q10: The sample size in each independent sample

Q26: Referring to Table 14-15, there is sufficient

Q40: Referring to Table 10-13, the null hypothesis

Q42: Referring to Table 11-8, what is the

Q53: The sample correlation coefficient between X and

Q98: Referring to Table 12-7, the value of

Q120: Referring to Table 14-4, what is the

Q133: If the Durbin-Watson statistic has a value

Q156: Referring to Table 14-3, the p-value for