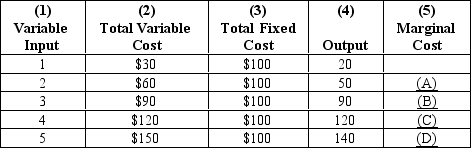

Exhibit 22-2

-Refer to Exhibit 22-2.What is the average total cost of producing 140 units of output?

Definitions:

State Unemployment Tax

A tax that employers are required to pay to their state government to fund unemployment benefits for workers who have lost their jobs.

Payroll Tax Expense

This refers to the taxes that an employer is responsible for paying on behalf of its employees, which generally include social security and Medicare taxes.

FICA Taxes Payable

Taxes owed by an employer, employee, or both, to the Federal Insurance Contributions Act for Social Security and Medicare.

Employer's Payroll Taxes

Taxes that an employer must pay based on the wages and salaries of its employees, which can include Social Security taxes, Medicare taxes, and unemployment taxes.

Q4: A monopolist maximizes profits at the output

Q31: Your school pays one rate for the

Q56: If a person's income and the prices

Q57: If the (average)tax rate falls by 10%

Q76: Refer to Exhibit 24-6.If C is the

Q79: A constant-cost industry is characterized by<br>A) an

Q126: As the marginal physical product curve rises,<br>A)

Q186: If income elasticity of demand for a

Q194: If quantity demanded is completely unresponsive to

Q214: Diseconomies of scale are present when the