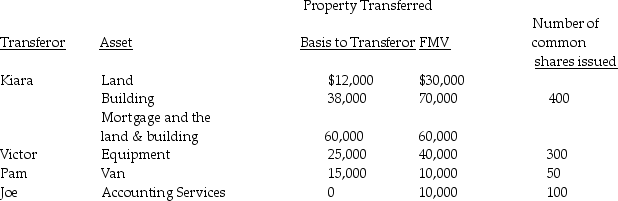

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a) Does the transaction satisfy the requirements of Sec. 351?

b) What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c) What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d) What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Porter's Five Forces Model

A framework for analyzing a business's competitive environment, focusing on five key forces that influence its ability to serve customers and turn a profit.

Substitute Products

Products that serve as alternatives to one another in the market, satisfying similar needs or wants of consumers.

Q27: Ward and June decide to divorce after

Q29: Maple Corporation distributes land to a noncorporate

Q44: Income in respect of a decedent (IRD)

Q53: Beta Corporation recently purchased 100% of XYZ

Q68: Calvin transfers land to a trust. Calvin

Q68: In a Sec. 332 liquidation, what bases

Q76: Compare the tax treatment of administration expenses

Q80: Identify which of the following statements is

Q84: Identify which of the following statements is

Q86: Identify which of the following statements is