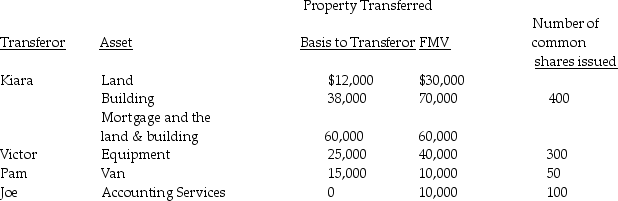

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a) Does the transaction satisfy the requirements of Sec. 351?

b) What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c) What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d) What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Disruptions

Events or activities that cause a disturbance or interruption in normal operations or supply chain activities.

Susceptibility

The likelihood or predisposition to be influenced or harmed by a particular factor or condition.

Transportation Cost

Expenses associated with the movement of goods or materials from one location to another, including fuel, labor, and maintenance expenses.

Economic Deregulation

Reduction of government power over certain industries, aimed at improving market efficiencies and fostering competition.

Q1: A trust reports the following results:<br>

Q8: Parent Corporation owns 70% of Sam Corporation's

Q15: Ball Corporation owns 80% of Net

Q19: What must be reported to the IRS

Q50: A shareholder's basis in stock received in

Q56: Identify which of the following statements is

Q57: Outline and briefly describe the estate tax

Q75: Identify which of the following statements is

Q85: A complex trust permits accumulation of current

Q105: Identify which of the following statements is