Figure 23.2

Figure 23.2

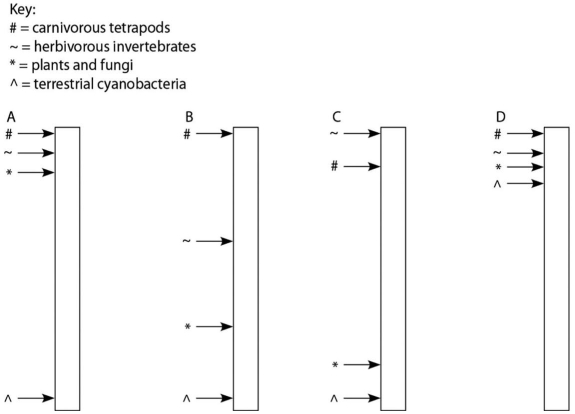

A sediment core is removed from the floor of an inland sea.The sea has been in existence,off and on,throughout the entire time that terrestrial life has existed.Researchers wish to locate and study the terrestrial organisms fossilized in this core.The core is illustrated in Figure 23.2 as a vertical column,with the top of the column representing the most recent strata and the bottom representing the time when land was first colonized by life.Assuming the existence of fossilized markers for each of the following chemicals,what is the sequence in which they should be found in this sediment core,working from ancient sediments to recent sediments?

1) chitin coupled with protein

2) chlorophyll

3) bone

4) cellulose

Definitions:

Plowback Ratio

A metric indicating the proportion of earnings retained by a company for reinvestment in its operations, rather than distributed to shareholders as dividends.

Dividend Growth Rate

The annualized percentage rate of growth of a company's dividend payments, indicating how quickly the dividend payments have grown over a specific period.

Expected ROE

The anticipated return on equity, calculated based on expected future earnings divided by shareholders' equity.

Expected ROE

The projected return on equity, which measures a company's efficiency at generating profits from every unit of shareholder's equity.

Q32: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7910/.jpg" alt=" Figure 20.20 Extrapolating

Q35: Which of the following functions as both

Q47: In Figure 20.6 below,which similarly inclusive taxon

Q58: If a bacterium regenerates from an endospore

Q61: Which of the following statements is true

Q62: The relative lengths of the frog and

Q63: Multicellular colonies of plant cells adhere to

Q72: Arrange the following terms from most inclusive

Q74: A mutation that is neither harmful nor

Q110: Suppose that the cells of seed plants,like