Figure 2.5

Figure 2.5

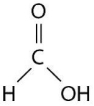

Figure 2.5 shows a representation of formic acid.A formic acid molecule

Definitions:

Activity-Based Costing

An accounting method that assigns overhead and indirect costs to specific activities, providing more accurate product costing.

Overhead Cost

Expenses related to the operation of a business that cannot be directly traced to a specific product or service, such as rent, utilities, and administrative costs.

First Stage Allocations

The initial process of distributing overhead costs to various cost pools or departments in activity-based costing.

Activity Rate

The cost driver rate in activity-based costing used to assign costs to cost objects, based on each cost object's usage or creation of costs.

Q5: Which functional group can act as a

Q16: Specific immunity is dependent on:<br>A) erythrocytes.<br>B) thrombocytes.<br>C)

Q18: Which of the following is an example

Q19: The top of the uterus between the

Q20: Which of the following statements about enzyme-catalyzed

Q71: The left-to-right position of an element in

Q81: Identical heat lamps are arranged to shine

Q109: What is the maximum number of hydrogen

Q120: Which drugs help increase WBC counts?<br>A) epoetin

Q220: What is the term for a smooth-muscle