Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

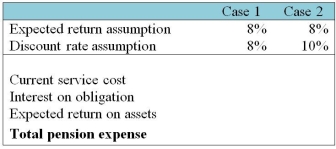

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Doctrine of Stability

A legal principle that aims to maintain long-term contracts or agreements to ensure reliability and predictability in business or international relations.

Constitutions

Constitutions are fundamental principles or precedents according to which a state or other organization is acknowledged to be governed.

Statutes

Laws enacted by legislative bodies at any level of government.

Regulations

Rules or directives made and maintained by an authority to regulate conduct or enforce policies.

Q8: Housing becomes a social welfare problem when:<br>A)there

Q8: What is a personality or social trait

Q17: What proportion of American children and adolescents

Q19: The conflict of values of the secular

Q20: The number of undocumented immigrants entering the

Q22: Calculate the incremental EPS for the

Q31: Which statement is not correct about financial

Q31: Which statement about warranties is correct?<br>A)Warranties are

Q60: As of January I,2014,the equity section of

Q63: Identify whether the following characteristics/facts are relevant