Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

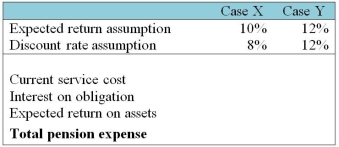

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Bystanders

Individuals who are present at an event or incident but do not take part.

Feeling Good

A state of well-being, happiness, or satisfaction.

Deserving of Help

The notion or principle that certain individuals or groups are considered worthy of receiving support, assistance, or aid due to their circumstances or conditions.

Blood Donors

Individuals who voluntarily provide their blood for use in transfusions or for the manufacture of blood products.

Q2: A company issued 100,000 preferred shares and

Q21: Which statement explains the risk involved in

Q23: Which item will be presented on the

Q24: Assume that Souse agrees to lease a

Q24: Differential Association Theory is the belief that:<br>A)crime

Q33: Explain what real-return bonds,convertible bonds and perpetual

Q78: Hamm Corporation had 200,000 ordinary shares outstanding

Q81: A company reported $430,000 of pension expense

Q82: Which statement is correct?<br>A)A deductible temporary difference

Q83: Which statement about contingencies is correct?<br>A)It involves