Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

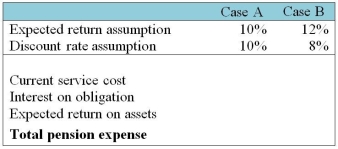

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Semi-Annually Compounded

A financial term where interest is added to the principal amount of an investment or loan twice a year, resulting in compound growth.

Semi-Annually Compounded

Interest or finance charges are applied to the principal sum twice a year, causing the investment or loan to grow at a faster rate than simple annual compounding.

RSP

Registered Savings Plan, a financial account in Canada designated for holding savings and investment assets, with special tax benefits for retirement savings.

Monthly Compounded

Pertains to interest or any financial metric that is calculated and added to the principal balance every month.

Q11: Quotas on immigrants from particular countries were

Q12: While the unemployment rate for whites in

Q19: The conflict of values of the secular

Q22: Assume that Speery agrees to lease a

Q37: Which statement is correct about the "two

Q42: Which statement is correct?<br>A)A held for trading

Q55: Which statement is correct?<br>A)Supplier discounts can only

Q58: Which statement is correct?<br>A)Diluted EPS will always

Q66: A company located in Canada spends $2,000

Q75: The following data represent the differences