Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

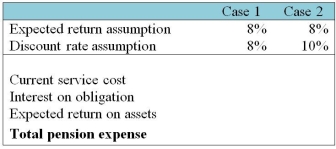

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Tasty Food

Edible substances that are perceived as having a pleasant flavor profile by the taste receptors.

Discriminative Stimuli

A specific stimulus in the presence of which a particular response is more likely to be reinforced, and in the absence of which a response is not reinforced.

Stimulus Generalization

The process by which a response is elicited by stimuli similar to the original stimulus associated with that response.

Higher-Order Conditioning

Higher-order conditioning is a process in classical conditioning by which a conditioned stimulus comes to signal another stimulus that is already associated with an unconditioned stimulus, leading to the same conditioned response.

Q1: Explain the nature of current liabilities and

Q14: Liberals and radicals tend to view poverty

Q15: Explain the meaning of financial leverage and

Q16: What is the main difference between the

Q20: Gentrification is good for everyone except for:<br>A)historical

Q47: What adjustment is required to the

Q59: Zarlon Leasing Company agrees on January 1,2012

Q61: Two different companies have many similarities,including the

Q73: Which statement best describes the accounting when

Q76: Which statement is correct?<br>A)Financial reporting rules are