Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

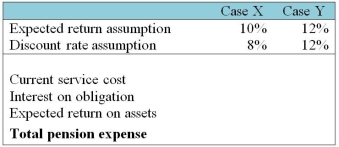

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Property Taxes

Taxes paid by property owners, based on the value of their property, to support local services and infrastructure.

City Referendum

A direct vote by the electorate on a specific proposal or issue within a city, which has been brought forth by a government or a group of citizens.

Term Paper

A research paper written by students over an academic term, accounting for a large part of their grade.

Performance Anxiety

The fear or persistent phobia which may impede on the performance of an individual during a test or public speaking, often characterized by intense nervousness or distress.

Q10: Which statement is not correct?<br>A)A bank loan

Q10: The Americans with Disabilities Act of 1990

Q10: The vast majority of older Americans live

Q10: One of the explanations for increased reporting

Q11: The following information relates to the

Q16: What is cash management?<br>A)Cash management includes the

Q25: What are positive and negative covenants? Give

Q27: A company issues convertible bonds with face

Q43: Which of the following is an example

Q74: Calculate the income effect on the