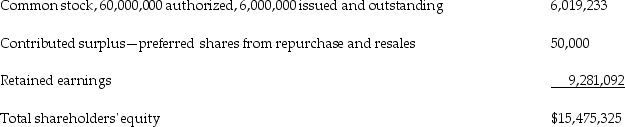

The following is an extract from the balance sheet as at December 31,1011:

at $6 per share,250,000 authorized,25,000 issued and outstanding

at $6 per share,250,000 authorized,25,000 issued and outstanding

The company did not declare dividends on preferred shares in 2011.Transactions in 2012 include the following:

The company did not declare dividends on preferred shares in 2011.Transactions in 2012 include the following:

i.March 15: Hewitt purchased 15,000 preferred shares on the stock exchange for $5.25 per share and held these in treasury.

ii.March 28: The company redeemed 5,000 preferred shares directly from shareholders.

iii.July 1: The market price of common shares shot up to $5 per share,so Hewitt decided to split the common shares two to one.

iv.August 1: Hewitt cancelled 14,000 preferred shares that were held in treasury.

v.December 31: The company declared dividends of $0.40 per common share.

Requirement:

Prepare the journal entries to record the above transactions.The company uses the single-transaction method to account for treasury shares.

Definitions:

Q4: The material to be included in a

Q4: A regression analysis has shown that there

Q15: Explain how a change in the following

Q21: Which statement explains the risk involved in

Q31: The cutoff score is the criterion score)

Q46: On May 1,2014,SBC INC.buys a photocopier listed

Q47: In discriminant analysis, with M groups and

Q49: Which of the following is not true

Q62: Use the following information to calculate

Q79: What is a "future"?<br>A)A contract in which