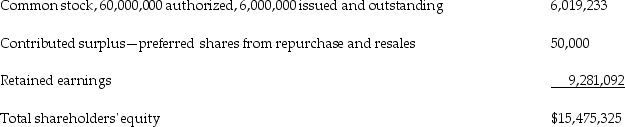

The following is an extract from the balance sheet as at December 31,1011:

at $6 per share,250,000 authorized,25,000 issued and outstanding

at $6 per share,250,000 authorized,25,000 issued and outstanding

The company did not declare dividends on preferred shares in 2011.Transactions in 2012 include the following:

The company did not declare dividends on preferred shares in 2011.Transactions in 2012 include the following:

i.March 15: Hewitt purchased 15,000 preferred shares on the stock exchange for $5.25 per share and held these in treasury.

ii.March 28: The company redeemed 5,000 preferred shares directly from shareholders.

iii.July 1: The market price of common shares shot up to $5 per share,so Hewitt decided to split the common shares two to one.

iv.August 1: Hewitt cancelled 14,000 preferred shares that were held in treasury.

v.December 31: The company declared dividends of $0.40 per common share.

Requirement:

Prepare the journal entries to record the above transactions.The company uses the single-transaction method to account for treasury shares.

Definitions:

Raider

An individual or company that aims to take over another company, often by buying a substantial amount of its stock.

Directors' Meeting

A formal gathering of the board of directors of a corporation to discuss and make decisions on company policy and management.

Internet Platform

Digital platforms operating online, providing a range of services, including social media, e-commerce, and information exchange.

Audio And Video

Technologies and devices used to record, transmit, store, process, and playback sound and visual media files.

Q10: Which statement is accurate?<br>A)The taxes payable method

Q13: Which statement about contingencies is correct?<br>A)If the

Q17: For discrimination to be based on all

Q22: Explain the meaning of "contributed capital" and

Q27: How are "purchase discounts lost" reported in

Q37: Larger values of Wilks lambda indicate that

Q49: In the first year of operations,a company

Q58: Explain the difference between "probable," "possible," and

Q60: Physiological measures such as GSR are used

Q61: For the following lease,determine the minimum