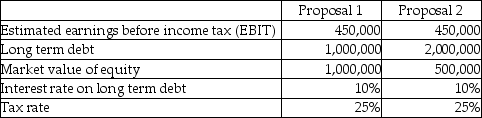

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements

Requirements

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Definitions:

Tax

Mandatory monetary contributions or other forms of taxes levied on individuals or entities by government agencies to support government operations and a range of public services.

Supply Curves

A graphical representation that shows the relationship between the price of a good and the quantity of that good that producers are willing to supply.

Levied

Levied refers to the imposition of a tax, fee, or fine by a governmental authority, requiring payment from individuals or organizations.

Supply Curve

A graphical representation showing the relationship between the price of a good or service and the quantity supplied by producers over a period of time.

Q17: For discrimination to be based on all

Q20: The simple correlation between the independent variable

Q29: Assume that a company issued 10,000 shares

Q32: Blocks in a blockchain hold batches of

Q49: Explain the difference between basic and diluted

Q50: Sad Man Inc.had 220,000 ordinary shares outstanding

Q51: Which of the following component refers to

Q53: On April 1,2013,a company sold $3,500,000 of

Q56: Accu Tech Renovations Corp.(ATRC)was incorporated on January

Q94: Masons' balance sheet shows a defined benefit