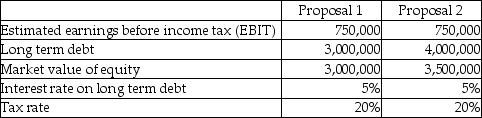

Universal Inc.is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements:

Requirements:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

Definitions:

Graduated Commission

A commission structure where the rate of commission increases with the level of sales or transactions completed.

Average Rate

The mean value of rates over a specified period or under certain conditions.

Mortgage Rate

The interest rate charged on a mortgage, typically expressed as an annual percentage.

GST

Goods and Services Tax, a type of value-added tax imposed on the majority of goods and services that are sold within the country for local use.

Q7: Partial correlation coefficient is the measure of

Q25: In one-way ANOVA, we primarily look to

Q33: Which one of the following is the

Q50: Here is an extract of a trial

Q52: Initial starting points in nonhierarchical clustering is

Q55: If 1,000 shares with a par value

Q57: The critical assumption of ASSESSOR is that

Q62: Burlington Corp.has a single class of shares.As

Q76: Gladstone Distributors Inc.entered into a non-cancellable contract

Q77: Compare the impact of finance leases and