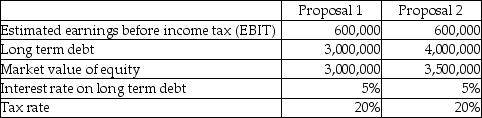

Fast Track Inc.is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements:

Requirements:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

Definitions:

Clinically Significant

A measure of intensity, duration, or frequency of symptoms that signifies a notable departure from normal functioning.

Emotion Regulation

The methods or strategies individuals use to manage and control their emotional responses to situations.

Cognition

The activity of understanding and learning through the acts of contemplation, undergoing experiences, and the faculties of the senses.

Biologically Influenced

Pertaining to traits, behaviors, or disorders that are shaped in part by genetic, physiological, and neurological factors.

Q7: A good descriptive statistic of measuring the

Q18: If a clustering procedure starts with one

Q18: Micky and Donald Corp.was founded on

Q22: Explain the meaning of "contributed capital" and

Q32: Which method must be used under ASPE

Q41: What is the meaning of "net income

Q51: Assume that a company issued 10,000 shares

Q64: There are three independent situations summarized below.In

Q81: Under the accrual method,what is the

Q84: What is the corridor limit for