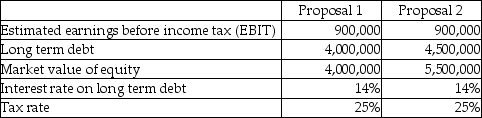

Bank Buy Inc.is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements

Requirements

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Definitions:

Five Forces Model

A framework developed by Michael E. Porter to analyze a business's competitive environment in five key areas: competitive rivalry, the threat of new entrants, the threat of substitute products, the bargaining power of suppliers, and the bargaining power of buyers.

Competitive Forces

External factors that influence the competitive position of a firm within an industry, including competition, potential entrants, substitutes, buyers, and suppliers.

Profitability

A measurement of the efficiency and effectiveness of a company at generating profits from its operations.

Competition And Profitability

The relationship between the competitiveness of a market and the ability of firms within that market to generate profits.

Q1: A strong and continued relationship with the

Q8: A company facing a 45% tax rate

Q9: Bold Accountants Co.sells $6,000,000 of 10-year,6% bonds

Q13: When preferences for various attributes are in

Q19: Which of the following characteristic is required

Q47: What adjustment is required to the

Q47: For the following lease,determine the minimum

Q59: Explain the accounting for defined contribution plans

Q66: Which statement is correct?<br>A)Contingencies arise from future

Q75: Missouri Wheels Ltd.(MW)sold $9,000,000 of fourteen-year,3% bonds