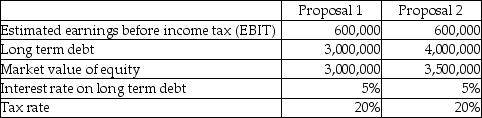

Fast Track Inc.is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements:

Requirements:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

Definitions:

Asterisk

A typographical symbol (*) used for various purposes, including indicating footnotes, corrections, omissions, and multiplication in mathematics.

Quota

A fixed share or limit of items or resources that can be allocated, produced, or consumed.

User Accounts

Digital profiles that represent individuals in a computer system, enabling them to access and interact with software and services.

Compressing

The process of reducing the size of a file or data to save space or transmission time.

Q1: In both principal components analysis and varimax

Q13: Which statement is correct about offsetting?<br>A)Offsetting generally

Q17: Information pertaining to customer habits and preferences

Q33: Under the accrual method,what is the

Q38: The laboratory test market includes a simulated

Q40: Arlington Corp issued $7,000,000,5% 4-year bonds on

Q43: Multidimensional scaling addresses the general problem of

Q64: Calculate the incremental EPS for the

Q68: Legally Yours,a law firm,sells $8,000,000 of four-year,8%

Q73: Which statement is correct about financial and