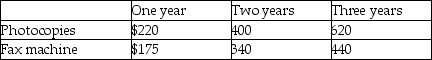

LMZ Computer Systems Inc.maintains office equipment under contract.The contracts are for labour only; customers must reimburse LMZ for parts.LMZ's rate schedule follows:

LMZ's 2018 sales of maintenance agreements is set out below:

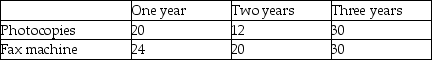

LMZ's 2018 sales of maintenance agreements is set out below:

Requirements:

Requirements:

Assuming that sales occurred evenly through the year:

a.What amount of revenue will LMZ recognize for the year ended December 31,2018?

b.What amount of deferred revenue will LMZ report as a current liability on December 31,2018?

c.What amount of deferred revenue will LMZ report as a non-current liability on December 31,2018?

Definitions:

Increase in Price

A situation where the cost of a product or service rises over a period of time.

Excise Tax

A tax levied on specific goods, services, or transactions, often with the aim of reducing their consumption or raising revenue.

Imported Items

Goods brought into a country from abroad for sale.

Tariff

A tax imposed by a government on goods and services imported from other countries to protect domestic industries or to generate revenue.

Q7: In weighting, categories that are underrepresented in

Q9: A company earns $390,000 in pre-tax income,while

Q13: Which statement is correct about offsetting?<br>A)Offsetting generally

Q15: If the allowed error is increased, the

Q20: Assume that Aero agrees to purchase US$50,000

Q24: Which statement is correct?<br>A)A complex capital structure

Q24: Compare and contrast the two methods for

Q31: The probability that X<sub>1</sub> will exceed 9

Q38: A plot of eigenvalues against the number

Q57: What are "stripped bonds"?<br>A)Bonds that pay the