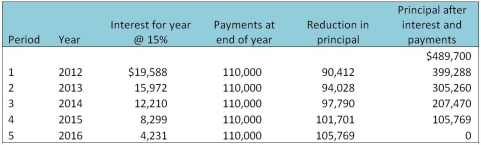

The following amortization schedule is for a lease entered into at the start of fiscal 2012 for an asset that will be useful for 5 years. The company uses straight-line depreciation method.

Required:

Required:

Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31,2013,distinguishing amounts that are current from those that are non-current.

Definitions:

Federal Rule Of Evidence

A set of regulations adopted by United States federal courts governing the admission and use of evidence in proceedings.

Disparagement

In tort law, any false statement made to others that questions the legal ownership or raises doubts as to the quality of merchandise.

Reasonably Foreseeable

A legal standard used to determine if a person could predict or expect a certain outcome as a result of their actions.

Q1: plagiarism

Q11: What is a deferred tax asset?<br>A)A deductible

Q14: Which statement is correct about potential ordinary

Q16: What is the corridor limit for fiscal

Q17: scale

Q22: ecological fallacy

Q34: Under the accrual method,what is the effect

Q37: A company had taxable income of $12

Q39: Explain why other comprehensive income is excluded

Q56: Who coined the term "public sociology"?<br>A)Emile Durkheim<br>B)Herbert